In all energy projects, financial stability hinges on precise management of the risk profile and fine margins. Among the many financial protections available, ensuring an appropriate indemnity period in the business interruption section of insurance policies is one of the most overlooked, yet crucial considerations. When this period falls short, the consequences extend far beyond mere delays—leading to heightened financial exposure, impaired revenue streams, and long-term project instability.

40% of companies do not reopen after a disaster and another 25% fail within one year of reopening.

For investors, project managers, and equity partners, understanding and securing a consequential loss indemnity period that aligns with today’s real-world disruption timelines is essential for maintaining profitability, ability to service debt, pay fixed costs and mitigate other financial risks.

The Risks of an Insufficient Indemnity Period

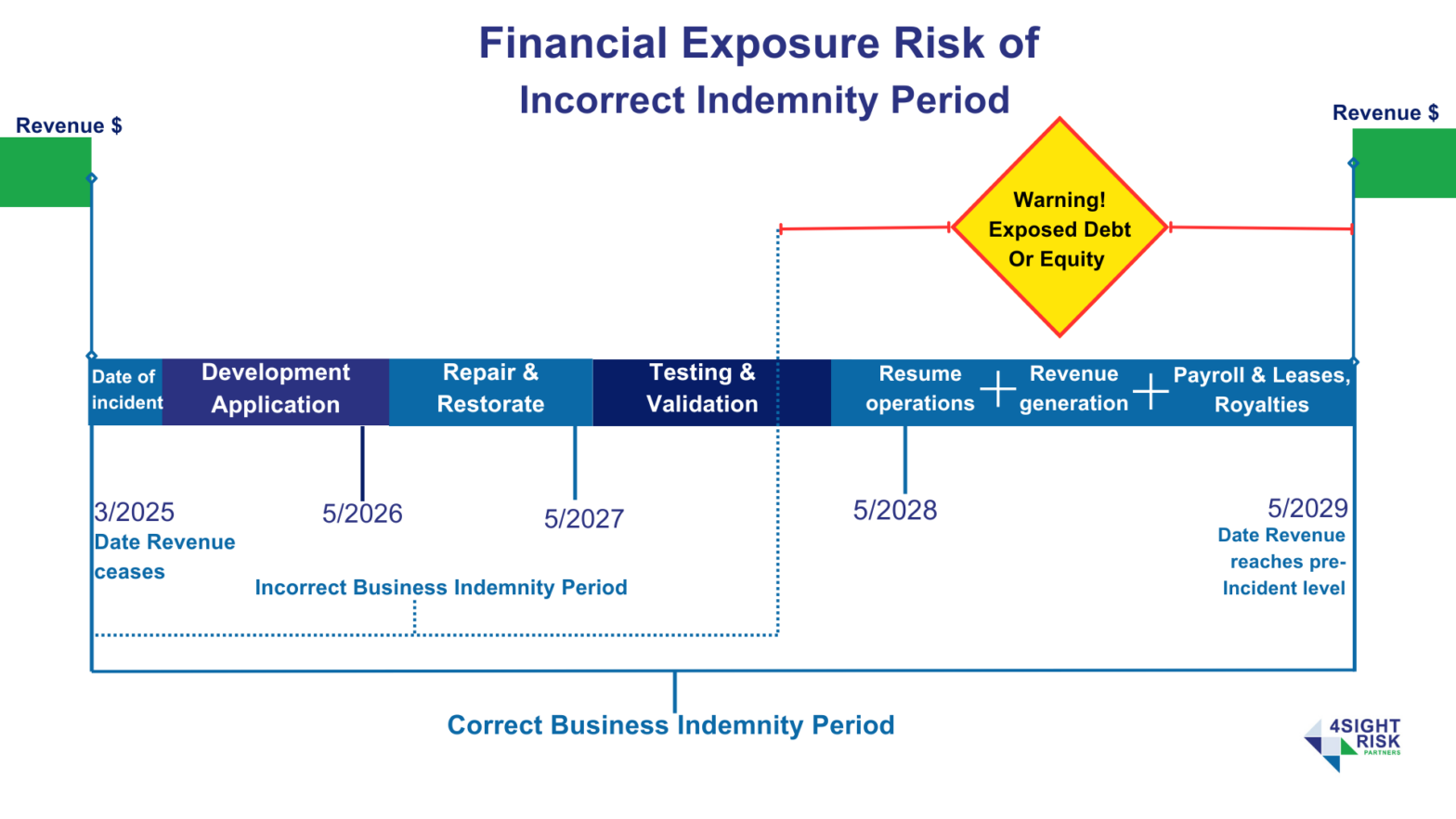

The indemnity period in consequential loss (business interruption) insurance is designed to cover lost revenue and expenses incurred to mitigate losses and additional expenses incurred, due to unforeseen disruptions. However, if the scope of cover is incorrectly structured, or this period is too short, several key risks emerge:

1. Extended Revenue Loss Beyond Coverage – all energy projects face complex delays, from regulatory approvals and supply chain constraints to construction setbacks. If the indemnity period expires before revenue returns to pre-incident levels, the financial burden shifts entirely onto the business.

2. Rising Debt and Equity Pressure – Investors and lenders expect a return on capital within defined timeframes. Delays without sufficient insurance coverage can lead to increased debt servicing costs, reduced equity value, and even the potential loss of investor confidence.

3. Technology and Output Exposure – Renewable energy technology (in particular) evolves rapidly. If a project is insured for a like-for-like replacement but the market offers a significantly improved solution, the project may face an output deficit. For example, if a 10GW system is replaced with identical capacity while competitors are deploying 100GW solutions, future revenue potential is impaired.

4. Increased Exposure to Supply Chain and Market Forces – A too-short indemnity period may not account for global supply chain disruptions, inflationary pressures on materials and labour, or logistical delays in equipment replacement—leading to unexpected cost overruns and financial instability.

Key Considerations for Determining an Appropriate Indemnity Period

When structuring the indemnity period for business disruption insurance, project stakeholders should factor in the following:

· Development and Regulatory Approval Timelines – The time required to obtain planning, environmental, and operational permits following an incident.

· Regulatory approval to remove damaged structures – The planning and approval to remove oils and other environmentally sensitive items from remote areas can take some time; particularly if an official investigation or evidence collection is undertaken.

· Supplier and Construction Lead Times – The availability of critical components and the time needed for reconstruction.

· Debt and Equity Repayment Obligations – Ensuring financial commitments are met even in case of disruptions.

· Payroll, Lease, and Royalty Payments – Covering ongoing financial obligations despite delays.

· Return to Pre-Incident Revenue Levels – Aligning the indemnity period with the time required to achieve full operational output and revenue recovery. Amidst navigating the critical transition of construction to operation.

Strengthening Resilience: Expediting Expenses and Additional Cost Coverage

To further enhance financial protection, renewable energy projects should consider:

✔ Expediting Expenses Coverage – Enabling priority access to materials, labour, and equipment through premium supply chain fees or airfreight options to accelerate recovery.

✔ Extra Cost of Reinstatement Coverage – Ensuring access to better technology rather than just like-for-like replacement, protecting long-term revenue potential.

✔ Aggregation Exposure Strategy – Addressing regional risks, particularly in areas vulnerable to natural disasters, through tailored risk management solutions.

Protect Stakeholder Interests with a Specialist Risk Advisor

Navigating the complexities of indemnity period structuring requires expert guidance. A specialist insurance and risk advisor can help project stakeholders requirements and align insurance coverage with today’s real-world project risks, ensuring that financial protection extends through the full duration of recovery.

At 4Sight Risk Partners, we specialise in renewable energy risks—securing comprehensive business interruption coverage that protects against delays, financial exposure, and revenue impairment. Because insurance isn’t just an expense—it’s a strategic investment in long-term project success.

Want an Renewable Energy Risk & Insurance Specialist to independently assess your project? We work closely with clients to undertake detailed loss scenario modelling, ensuring the indemnity period meets the needs of all stakeholders.

Get in touch today—whether you need full-service support or an independent consultancy to assess your project, investment, or financially dependent asset, we’re ready to help you move forward with confidence.

______

Smart Decisions Faster.

At 4Sight Risk Partners, we protect what matters most, enabling you to move forward with confidence. Our team specialises in managing business risks and delivering world-class insurance solutions.

With over 75 years of global expertise, our proprietary IQ-ARTA Framework helps clients make informed decisions based on qualified risk profiles and quantified risks. By leveraging a global network of subject matter experts and leading insurers like Lloyd’s of London, we provide tailored solutions to address complex challenges across industries.

As specialists in Renewable Energy, we guide clients through all seven project stages and transition risks—helping to power and protect the future. Additionally, through Insurance Advisernet’s award-winning network, we offer trusted advice and advocacy, with a remarkable 98% client retention rate.

Explore more at 4sightrisk.com.au or reach out to discuss how we can help you make smart decisions faster.

Gareth Jones

Managing Director

4Sight Risk Partners

[email protected]

0499 988 980

+61 499 988 980 if calling outside of Australia

Adviser Representative No: 1251287

For more information please visit: 4sightrisk.com.au

Or reach out for assets or further details to:

[email protected]

Marketing & Communications

4Sight Risk Partners