Do you have a combined asset / stock and gross profit sum insured of over $10m?

If so, then a bespoke Industrial Special Risk (ISR) composite policy may be required.

ISR policies cover a business’s assets (including both fixed and mobile plant, but excluding registered motor vehicles), as well as business interruption losses—such as profits, increased costs of working, payroll, and other fixed expenses.

These policies can cover multiple sites worldwide and typically include protection against common perils such as fire, flood, storm damage, theft, malicious damage, and accidental damage.

The Consequential Loss or Business Interruption section of an ISR policy plays a vital role in protecting a business’s cash flow, revenue, and fixed expenses. Statistics show that up to 80% of businesses fail within 18 months of a major incident—particularly if they lack effective business continuity plans. Insurance can form an integral part of such a plan.

A properly constructed Consequential Loss / Business Interruption section of the ISR policy can cover:

- Loss of Gross Profit

- Additional Increased Cost of Working (i.e. expenses incurred over and above normal operating costs)

- Increased Cost of Working (i.e. expenses to minimise or reduce loss of profit due to an incident)

- Payroll

- Debt Repayments

- Rent

- Royalties

- Contractual Commitments (excluding those with Force Majeure provisions)

- Claims Preparation Costs / Professional Fees

Consequential Loss or Business Interruption cover can also protect your business from financial losses caused by an insured event occurring at a critical customer’s or supplier’s premises—or at another of your own sites, if other divisions are dependent on supply from that location. This is especially important in today’s dynamic and often fragile supply chains.

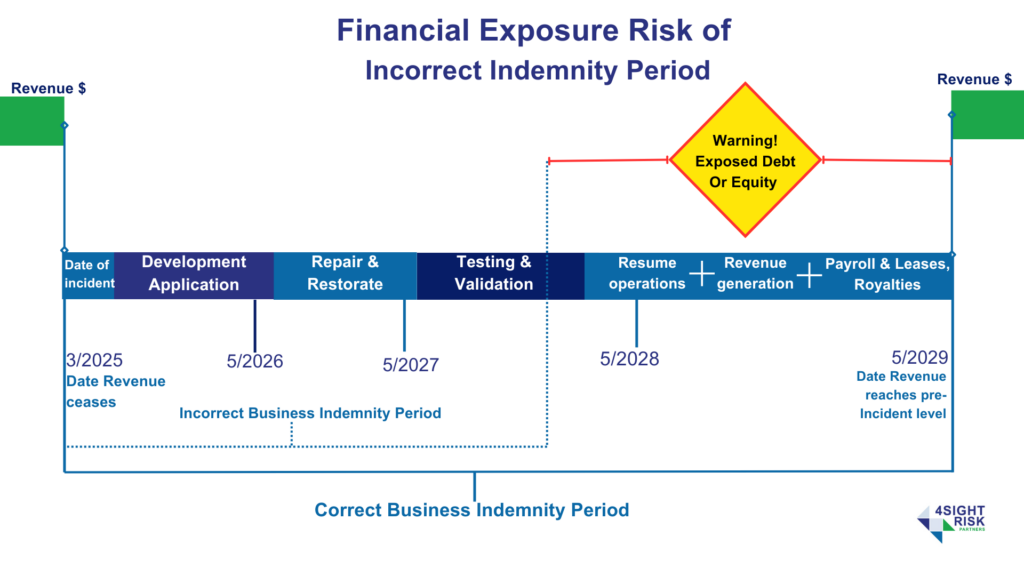

A critical element of Consequential Loss cover is the indemnity period—the period stated in the policy during which the insurer will continue to pay for loss of profit and other related expenses. This period must reflect the realistic time it would take to:

- Resume operations to pre-loss income/profit levels

- Demolish damaged premises

- Obtain development approvals

- Rebuild

The image below highlights the financial risk of an inadequately set indemnity period compared to a correctly calculated business indemnity period.

Business this is recommended for:

Customised ISR policies are recommended for all businesses with declared values over $10m. Business with less than $10m qualify for the composite Business Pack policies.

Common Questions

What is ISR insurance?

Industrial Special Risks (ISR) insurance is a comprehensive policy designed to protect businesses with high-value assets. It typically covers physical loss or damage to buildings, contents, and stock, plus financial loss from business interruption.

Who needs ISR insurance?

ISR insurance is best suited for medium to large businesses—especially those with assets over $10 million—such as manufacturers, warehousers, distributors, wholesalers, commercial property owners, and large retailers; especially those with critical supply chain issues.

What does an ISR policy cover?

Typically, ISR policies have two main sections:

- Section 1: Physical loss or damage (e.g., fire, storm, flood, malicious damage, theft and accidental damage).

- Section 2: Business interruption (e.g., loss of income and fixed costs as a consequence of property damage).

What is not covered under ISR insurance?

Common exclusions include wear and tear, gradual deterioration, maintenance breakdowns, war, nuclear risks, intentional damage, and certain cyber events unless endorsed. Always review exclusions with your Advisor.

How is ISR different from a Business Pack policy?

ISR is more flexible and tailored, with broader cover, territorial scope and higher limits; including loss resulting from a customer or suppliers’ premises (e.g. third-party warehouse). Business Pack policies are more rigid, suitable for small businesses with lower risk profiles.

What is ‘Declared Value’ vs. ‘Limit of Liability’ in an ISR policy?

- Declared Value: The estimated replacement value of assets or income to be insured.

- Limit of Liability: The maximum the insurer will pay—which should be set higher to allow for inflation, removal of debris and indemnity period.

What is a co-insurance or average clause?

A co-insurance or average clause applies as an implied penalty if a property is underinsured; as the insurer consider that they have not been paid the full premium for the risk. Therefore, if the sum insured is less than the actual replacement or reinstatement value, any claim payout may be reduced proportionally. This means you might only receive a portion of your claim, in line with the level of underinsurance. Accurate valuation is essential—especially for imported equipment, where currency fluctuations can impact replacement costs.

Can ISR insurance include machinery breakdown or theft?

Yes—ISR policies can be extended to include additional perils like machinery breakdown, theft, and even cyber (by endorsement). These should be reviewed with your Advisor.

How often should ISR coverage be reviewed?

At least annually or whenever your business undergoes major changes (e.g., expansion, equipment upgrades, new locations, new supplier/ customer).

Why is ISR insurance important for business continuity?

ISR protects not just assets but income. Without it, a single event like a fire or flood can halt operations and create significant financial strain.