The Asia–Pacific renewable energy sector is surging—but so are cyber threats targeting critical infrastructure. In Australia alone, over 100 large-scale renewable energy projects are now operating or under construction, representing more than 17 GW of capacity, according to the Clean Energy Council. As operational technology (OT) and IT systems converge, threat actors see opportunity. From solar and wind farms to battery and green hydrogen assets, the risk of business-wide disruption is no longer hypothetical—it’s here. Many of these assets are remote and monitored remotely, which leaves them vulnerable to outside cyber-attacks.

In August 2023, Energy One, a Sydney-based energy software provider, experienced a significant cyberattack. The breach affected certain corporate systems in both Australia and the United Kingdom. This incident underscored the potential risks associated with software suppliers i.e. the supply chain integral to the energy sector’s operations. Given Energy One’s role in providing software solutions for energy trading and operations, the breach raised concerns about the broader implications for energy grid security and the potential for cascading effects on energy distribution and management systems. pv-magazine-australia.com

Why This Matters to Your Project

A cyber-attack on a renewable asset can cascade far beyond temporary system downtime. The impact often includes:

- Financial – ransomware, data loss, lost revenue

- Property – damage to turbines, batteries, or OT

- Legal/Regulatory – breach of data or compliance obligations

- Reputation – shaken investor and community trust

- Operational – prolonged outages due to complex restarts or partner / supply chain delays

When cyber risk isn’t properly quantified, your insurance program may leave you exposed—especially when it comes to business interruption.

What You Should Be Doing

Quantify Total Exposure

Model worst-case cyber scenarios—then assess the full financial, legal, reputational, and property implications across your portfolio.

Map Critical Dependencies

Trace system and supply chain interconnections. What third parties could amplify disruption? Which OT/IT systems create single points of failure?

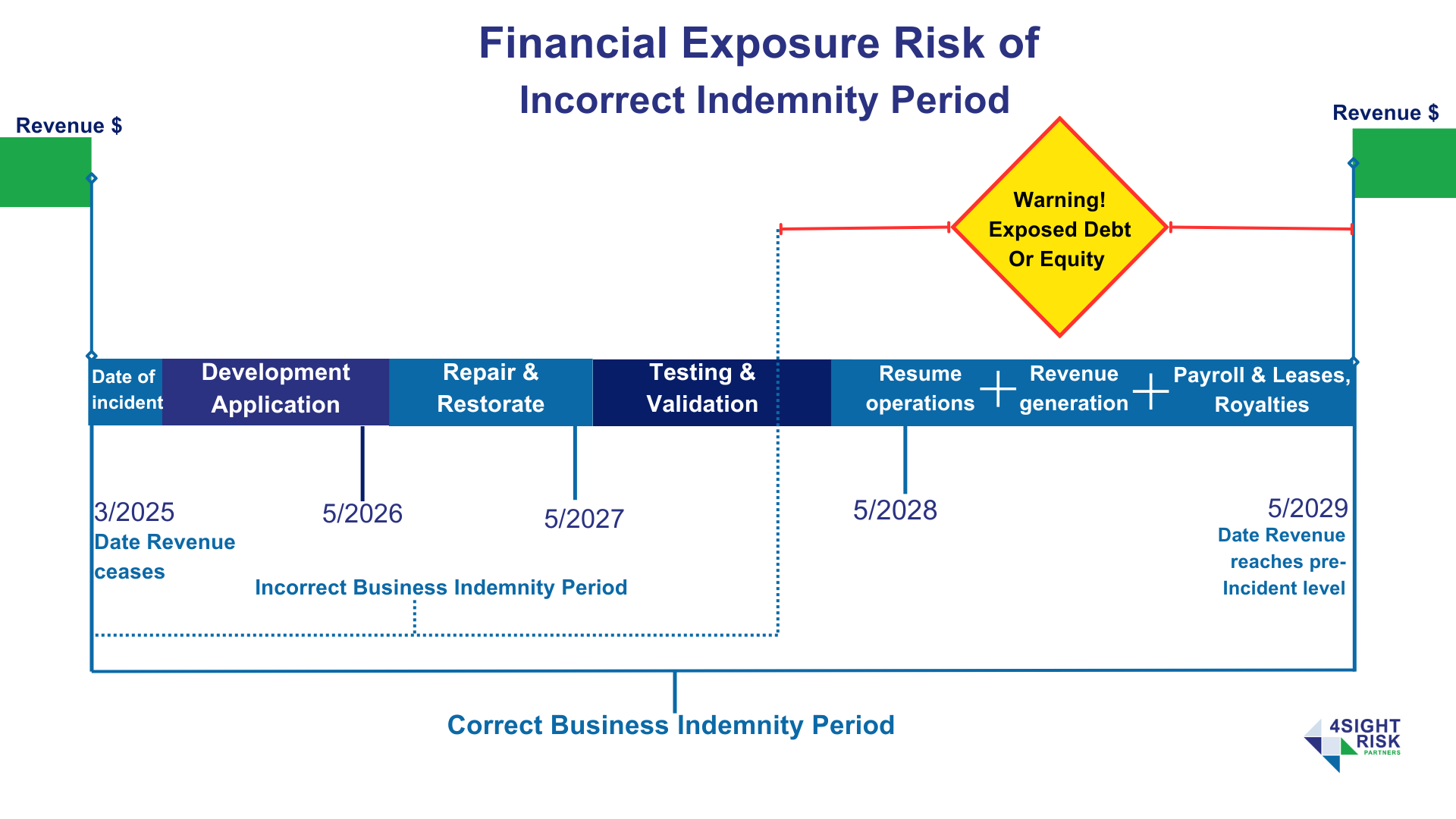

Review Business Interruption Cover

Ensure the indemnity period matches the real-world downtime that could follow a cyber event. For renewable projects, restart timelines can be complex—don’t assume 3–6 months is sufficient.

Overlay Risks with Insurance

Align your cyber and property insurance with actual material risks—not just market templates. Identify underinsured areas and mismatches between exposure and policy wording.

Why Work with Gareth Jones and 4Sight Risk Partners

🔹 Gareth Jones is a Specialist in Renewables

With over 35 years of global experience, Gareth advises on risk across solar, wind, hydro, BESS and green hydrogen projects. He has deep expertise in supporting complex energy infrastructure developments throughout the Asia–Pacific region and internationally. Gareth helps clients navigate and insure against the interconnected and transitional risks facing today’s energy sector—from cyber threats and natural catastrophes to long-tail liabilities and commercial disruption across the energy transition.

🔹 Proprietary Risk Framework

Using 4Sight’s IQ–ARTA methodology, Gareth helps clients quantify risk across all seven stages of the project lifecycle—including cyber vulnerabilities.

🔹 Insurance that Reflects Reality

Gareth’s deep international broker and underwriting relationships ensure insurance programs are not only comprehensive—but commercially viable and responsive when you need them most.

Don’t Wait for the Breach – Take Immediate Actions

Step 1: Request a cyber risk quantification review, tailored to your project size, tech stack and critical assets.

Step 2: Map internal and external dependencies—across technology, partners and OT.

Step 3: Validate your indemnity period—can your business interruption cover carry you through an extended outage?

Step 4: Overlay insurance with quantified risks and recalibrate for coverage gaps.

Let’s strengthen your cyber resilience—before you’re forced to test it.

Call Gareth Jones directly on +61 499 988 980

Or email: [email protected]

______

Smart Decisions Faster.

At 4Sight Risk Partners, we protect what matters most, enabling you to move forward with confidence. Our team specialises in managing business risks and delivering world-class insurance solutions.

With over 75 years of global expertise, our proprietary IQ-ARTA Framework helps clients make informed decisions based on qualified risk profiles and quantified risks. By leveraging a global network of subject matter experts and leading insurers like Lloyd’s of London, we provide tailored solutions to address complex challenges across industries.

As specialists in Renewable Energy, we guide clients through all seven project stages and transition risks—helping to power and protect the future. Additionally, through Insurance Advisernet’s award-winning network, we offer trusted advice and advocacy, with a remarkable 98% client retention rate.

Explore more at 4sightrisk.com.au or reach out to discuss how we can help you make smart decisions faster.

Gareth Jones

Managing Director

4Sight Risk Partners

[email protected]

0499 988 980

+61 499 988 980 if calling outside of Australia

Adviser Representative No: 1251287

For more information please visit: 4sightrisk.com.au

Or reach out for assets or further details to:

[email protected]

Marketing & Communications

4Sight Risk Partners