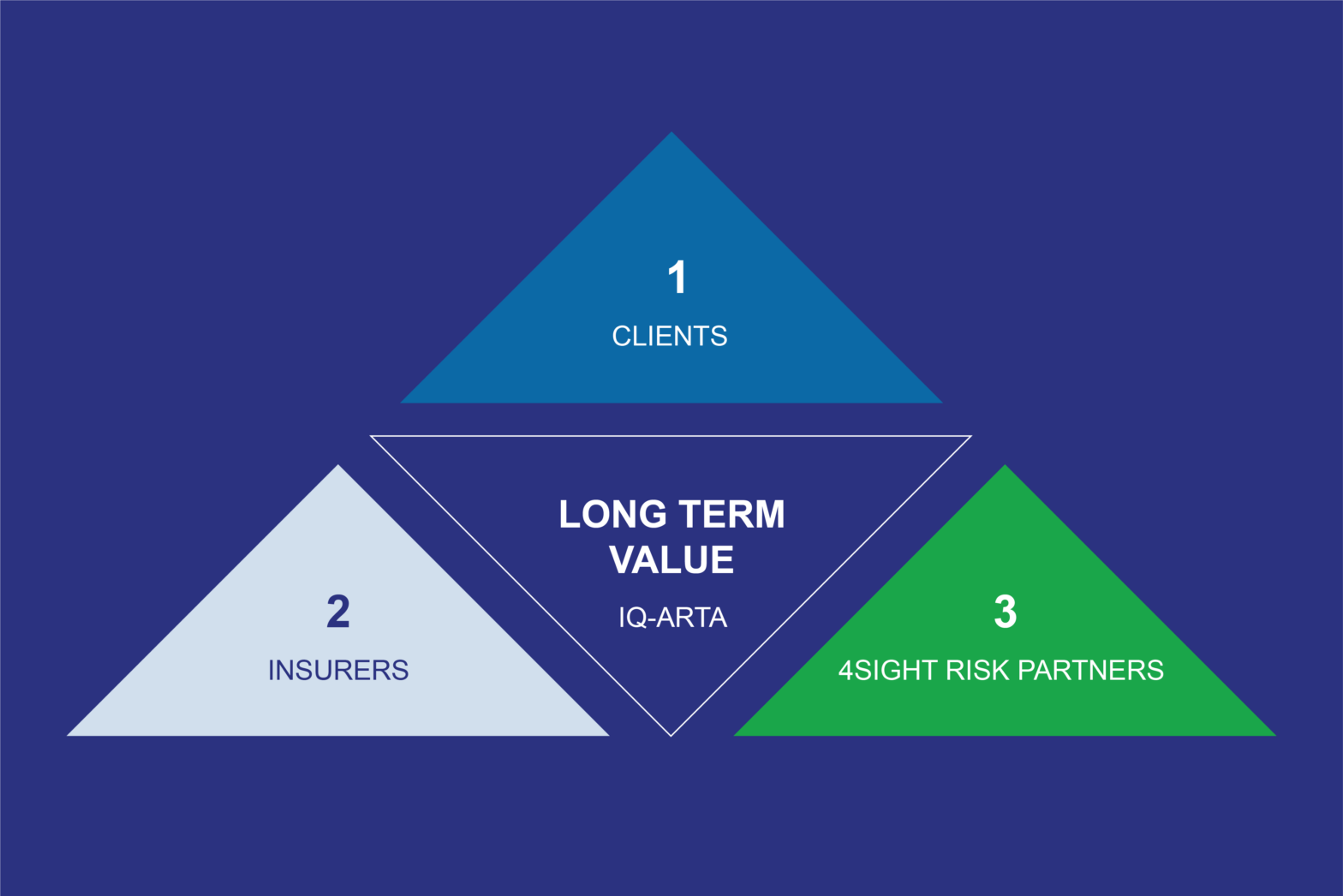

At 4Sight Risk Partners we want our clients and insurance partners to flourish, be financially secure and sustainable for the long term. So much so, we developed a comprehensive approach called IQ-ARTA that embodies our commitment to creating long-term value for all risk partners. By focusing on identifying, qualifying and quantifying risk, we can set up processes to mitigate risks; and properly define an insurance programme that aligns to our client’s risk profile. Our method not only correctly aligns an insurance programme, but it also eliminates wastage of premium (possibly over many years) that is being spent on redundant or unnecessary insurance coverage.

It also strengthens the triangular relationship between our clients, insurers and ourselves; as there is transparency in risk profile, alignment in insurance coverage, which eliminates potential disputes if a claim arises.

IQ-ARTA : A Strategic Investment

IQ-ARTA stands for:

- Identify & Quantify (IQ)

- Avoid (A)

- Reducing (R)

- Transferring (T) &

- Accepting (A)

Each step in our framework is designed to meticulously address various facets of risk management. The “Avoid” step is particularly significant, as it is here that we concentrate our teams collective experience on pinpointing business process improvements for our clients that diminish the likelihood of adverse events. By proactively identifying areas where risks can be mitigated, we help our clients build more resilient operations and save on insurance premiums.

This strategic investment in risk management fosters a deeper, more collaborative relationship between clients, insurers, and 4Sight Risk Partners. By working together to reduce risks in the business, we enhance protection for all stakeholders. Our clients benefit from fewer incidents, reduced premiums and insurers have a greater understanding of our client’s risk profile and therefore, face fewer claims.

The Power of the Avoid Step: Reducing Risk, Enhancing Value

The Avoid step is crucial in transforming our risk management approach from reactive to proactive. Rather than merely responding to incidents after they occur, we delve into our clients’ business processes to uncover potential vulnerabilities and areas for improvement. This might involve optimising supply chain operations, enhancing cybersecurity measures, or implementing more robust safety protocols.

These improvements significantly lower the probability of impacting events, which in turn reduces the overall risk profile of our clients. With fewer risks, the necessity for extensive insurance coverage diminishes, leading to cost savings on premiums. This not only benefits the clients financially, but also enhances their operational efficiency, stability and financial sustainability.

Strengthening the Triangular Relationship

Our IQ-ARTA approach is built on the foundation of a triangular relationship involving clients, insurers, and 4Sight Risk Partners. This relationship thrives on trust, transparency, and mutual financial stability. By actively working with clients to mitigate risks, we demonstrate our commitment to their long-term success and enable them to operate with a qualified risk profile and quantified risk appetite. Insurers, on the other hand, also benefit from this approach given a more predictable and manageable risk environment, leading to more favourable underwriting conditions and potentially lower premiums.

For our clients, this triangular partnership translates into tangible dividends during renewal periods and in the event of a claim. Insurers recognise the reduced risk profiles and are more likely to offer competitive terms, reflecting the improvements made through our IQ-ARTA approach. This not only enhances client satisfaction but also reinforces trust in 4Sight Risk Partners as a proactive risk advisor.

IQ-ARTA is a partnership approach

At 4Sight Risk Partners, our IQ-ARTA approach is more than just a risk management strategy; it is an investment in building enduring partnerships. By identifying and implementing business process improvements through our Avoid step…

Our client’s experience:

· reduced risks

· less reliance on insurance coverage

· qualified risk profiles and quantified risk appetite’s

· lower costs

· more effective insurance policies; and

· less disputes when a claim occurs.

Our insurance partners experience:

· Greater transparency

· More predictable and manageable risk

· More favourable underwriting conditions

This proactive approach strengthens the relationship between clients, insurers, and ourselves, ensuring long-term value and success for all parties involved. Through our IQ-ARTA framework, we are committed to being the trusted partner for our clients and insurers.

Reach out, to gain more confidence and strategic benefits from your business’s risk management.

______

Smart Decisions Faster.

At 4Sight Risk Partners, we protect what matters most, enabling you to move forward with confidence. Our team specialises in managing business risks and delivering world-class insurance solutions.

With over 75 years of global expertise, our proprietary IQ-ARTA Framework helps clients make informed decisions based on qualified risk profiles and quantified risks. By leveraging a global network of subject matter experts and leading insurers like Lloyd’s of London, we provide tailored solutions to address complex challenges across industries.

As specialists in Renewable Energy, we guide clients through all seven project stages and transition risks—helping to power and protect the future. Additionally, through Insurance Advisernet’s award-winning network, we offer trusted advice and advocacy, with a remarkable 98% client retention rate.

Explore more at 4sightrisk.com.au or reach out to discuss how we can help you make smart decisions faster.

Gareth Jones

Managing Director

4Sight Risk Partners

[email protected]

0499 988 980

+61 499 988 980 if calling outside of Australia

Adviser Representative No: 1251287

For more information please visit: 4sightrisk.com.au

Or reach out for assets or further details to:

[email protected]

Marketing & Communications

4Sight Risk Partners